As the calendar turns to 2024, the Internal Revenue Service (IRS) embarks on a pivotal tax season, equipped with new strategies and resources aimed at enhancing taxpayer support. This year, the IRS opens its doors to a season of change, welcoming over 146 million individual tax returns by the April 15 deadline. These efforts symbolize a significant shift in how the IRS plans to manage the influx of filings and taxpayer inquiries.

In a notable move increased by additional funding from the Inflation Reduction Act, the IRS is extending service hours at nearly 250 of its in-person Taxpayer Assistance Centers across the nation. This expansion is a direct response to the increasing demand for accessible and efficient tax assistance. Simultaneously, the IRS is diligently enhancing its phone services and online tools, particularly the

“Where’s My Refund?” platform, which is set to provide more comprehensive updates to taxpayers eagerly tracking their refunds.

However, these advancements do not come without their challenges. The IRS is currently navigating the complexities of a tax extenders bill coursing through Congress, which could bring significant changes to the Child Tax Credit and several business-related tax provisions. These potential legislative alterations add a layer of uncertainty to an already intricate tax landscape.

Amidst this backdrop of change and challenge, IRS Commissioner Danny Werfel emphasizes the gravity

of the tax season's commencement. "The start of a tax season is an important day for the nation and for

the IRS," Werfel remarks, highlighting the extensive preparations behind the scenes at the IRS.

Months of planning, programming, and testing culminate in the kick-off of the filing season, underscoring the IRS’s commitment to facilitating a smooth and efficient process for taxpayers. As Werfel notes, the tax season is not just a bureaucratic exercise but a fundamental right of citizenship, integral to the nation’s functioning.

In this blog, we will explore the IRS’s latest initiatives, the challenges they aim to address, and the broader implications for taxpayers and the tax community. Join us as we route the hints of the 2024 tax season, a period poised to redefine the tax filing experience.

The IRS’s Proactive Approach: A Statistical Overview

The IRS is set to handle an impressive 146 million tax returns by April 15, 2024, highlighting a critical demand for operational efficiency and accuracy. With Inflation Reduction Act funds, the agency is boosting services at 250 Taxpayer Assistance Centers nationwide, significantly enhancing in-person taxpayer support.

This expansion isn’t just about more hours; it’s a quality upgrade in taxpayer assistance, directly addressing the complexity of tax filing needs.

IRS Commissioner Danny Werfel underscored the importance of this season, stating, “The start of a tax season is an important day for the nation and for the IRS.” He highlighted the extensive IRS efforts in preparing for this season, showcasing a commitment to a seamless tax filing experience.

Despite these efforts, challenges loom, particularly with pending legislation that may impact key tax credits. However, the IRS stands ready to implement any new changes swiftly.

To further facilitate the filing process, phone services have been enhanced, and the “Where’s My Refund?” feature has been introduced to offer taxpayers better, more specific information. The IRS’s steps this season reflect its evolving role, focusing on better service and adapting to the dynamic tax landscape, demonstrating a commitment to taxpayer-centric initiatives and continuous improvement.

Understanding the Impact of New Resources and Tools

The IRS is revolutionizing its digital interaction for the 2024 tax season, notably through developments to the “Where’s My Refund?” online platform. This tool is poised to offer more in-depth insights for taxpayers tracking their tax refunds, marking a significant leap in digital service quality. This upgrade is a key element in the IRS’s initiative to make tax filing and refund tracking processes more transparent and user-friendly.

The enhanced “Where’s My Refund?” is not just an improvement; it’s a response to the growing need for digital efficiency in tax administration. By providing detailed, easy-to-understand updates, the IRS aims to streamline the experience for millions of taxpayers eagerly awaiting their refunds. This move is in line with the modern taxpayer’s expectations for accessible and responsive online services.

These digital improvements also signify the IRS’s commitment to adapting to technological advancements, ensuring their services meet the evolving needs of a digitally oriented public. The focus on enriching online tools underscores the IRS’s dedication to a taxpayer-centered approach, prioritizing ease of use and clarity in their digital interactions.

These enhancements to online resources such as “Where’s My Refund?” demonstrate a strategic move towards a more efficient, transparent, and approachable tax filing system, catering to the needs of the contemporary taxpayer.

Facing the Challenges Head-On

While the IRS strides forward with digital enhancements, it concurrently navigates through a depth of legislative complexities. A significant challenge is the looming tax extenders bill in Congress, a legislation that could significantly reshape aspects like

the Child Tax Credit and various business tax provisions. This bill represents a substantial layer of uncertainty for the tax landscape, necessitating a high degree of adaptability and vigilance from tax professionals.

This potential shift in tax legislation underscores the ever-evolving nature of tax law and the need for tax professionals to stay active. The possible changes could have wide-ranging impacts, affecting everything from individual tax liabilities to business tax strategies.

“For tax professionals, this means staying abreast of legislative developments is more crucial than ever”.

The IRS, for its part, is preparing to respond swiftly to any changes. Their readiness to adapt to new regulations demonstrates their commitment to maintaining a stable and responsive tax system.

“For tax professionals and taxpayers alike, it’s a reminder of the importance of being informed and prepared for shifts in tax policy”.

This scenario, while challenging, also presents an opportunity for tax professionals to showcase their expertise and adaptability. Directing through these legislative changes, they can provide invaluable guidance to their clients, helping them understand and adjust to any new tax realities.

IRS Commissioner’s Perspective

During the 2024 tax season, IRS Commissioner Danny Werfel has placed a significant emphasis on the role of this period in the national context. He regards the tax season as

a unique right of citizenship,” a statement that underscores the fundamental importance of this annual process. His perspective highlights the IRS’s comprehensive efforts to streamline the tax filing procedure, emphasizing the agency’s commitment to an efficient and effective system.

Commissioner Werfel’s remark about the tax season being a crucial function for the nation reflects a deep understanding of the IRS’s role in the larger societal framework. It acknowledges the responsibility the IRS holds in managing a system that affects nearly every citizen. His anticipation of issuing more than $300 billion in refunds this year is indicative of the vast scale of operations undertaken by the IRS. This figure alone underlines the magnitude and impact of the tax season on both individual taxpayers and the broader economy.

The Commissioner’s insights provide a valuable perspective on the tax season. They serve as a reminder of the criticality of the IRS’s work and its direct implications for millions of Americans. This viewpoint reinforces the importance of the IRS’s ongoing initiatives to enhance taxpayer services and adapt to legislative changes, ensuring the tax season runs as smoothly as possible for all involved.

The Financial Implications and Future Plans

As the IRS advances its operations for the 2024 tax season, financial considerations and future planning are at the forefront. The agency is actively working to prevent potential funding cuts that could significantly impact its operations.

A notable financial challenge is the reduction in extra funding, which was initially set at $80 billion over ten years but has been cut by about $20 billion. Despite these budgetary constraints, the IRS maintains a steadfast commitment to continuous improvement and efficiency in its services.

IRS Commissioner Danny Werfel has pointed out the critical difference that adequate funding makes in the functionality and effectiveness of the IRS. This sentiment is echoed throughout the tax community, underlining the importance of financial support for the agency’s success. A well-funded IRS is not just a matter of maintaining current operations but is integral to implementing advancements and improvements in taxpayer services.

Looking to the future, the IRS’s commitment despite budget cuts reflects a proactive approach to adapting and optimizing its operations. The agency’s focus on future readiness and adaptability, even in the face of financial challenges, demonstrates its dedication to serving the public and ensuring a smooth tax season. This dedication also signals the IRS’s intent to continue evolving and enhancing its services, ensuring that it remains responsive to the needs of taxpayers and the ever-changing tax landscape.

The IRS’s Response to Legislative Changes

The IRS is showcasing its agility and expertise as it prepares for potential shifts in tax legislation, particularly concerning the tax extenders bill. This bill, if passed, would introduce changes in key tax provisions, necessitating a prompt and effective response from the IRS.

IRS Commissioner Danny Werfel has confidently stated that the IRS is well-equipped to implement any new tax provisions swiftly following their enactment.

This readiness is crucial in ensuring that the implementation of legislative changes causes minimal disruption to taxpayers and tax professionals alike. Werfel’s assurance reflects the IRS’s resilience in adapting to legislative shifts. The agency’s ability to quickly update and modify its operations in response to new laws is a critical component of its commitment to maintaining a stable and reliable tax system. This responsiveness is not only about reacting to changes but also about anticipating and preparing for them, demonstrating a proactive approach to tax administration.

The IRS’s preparedness for legislative changes is a key factor in ensuring a seamless transition for taxpayers and a smooth continuation of services. It highlights the agency’s in-depth understanding of the tax code and its implications, further emphasizing the IRS’s role as a competent and dependable authority in tax matters.

Enhanced Customer Service and Digital Initiatives

The IRS is on track to significantly enhance its customer service, aiming for an 85% service level on its main phone line, a notable leap from previous years. This ambitious goal reflects the agency’s dedication to improving taxpayer interaction and support. The initiative is expected to reduce wait times and improve the overall efficiency of phone-based assistance, which has been a point of contention in the past.

In addition to phone services, the IRS is making substantial progress in expanding in-person assistance. This expansion is an acknowledgment of the diverse needs of taxpayers, some of whom prefer or require face-to-face support. By increasing the availability of in-person help, the IRS is catering to a broader range of taxpayer preferences and scenarios, making tax processes more accessible.

Another key development is the advancement of the

IRS’s Paperless Processing Initiative. This program represents a significant stride towards modernizing the tax filing and processing system. Going beyond mere digitization, this initiative is about transforming the tax experience into one that is more streamlined, less intimidating, and more environmentally friendly. By enabling electronic submission of forms and correspondence, the IRS is not only simplifying processes but also reducing the paper burden for both the agency and taxpayers.

INSIGHTS: By Filing Season 2024, taxpayers will be able to digitally submit all correspondence, non-tax forms, and responses to notices.

These initiatives collectively signify a shift in the IRS’s approach towards customer service and digital transformation. They are not just about adopting new technologies but also about rethinking and redesigning the taxpayer experience. The IRS’s efforts in these areas are crucial in making tax filing and processing more efficient, user-friendly, and less daunting for millions of Americans.

The Role of Technology in Tax Administration

The IRS is making significant advancements in integrating technology into tax administration, as exemplified by the latest updates to the “Where’s My Refund?” tool. This tool has been enhanced with voice bot technology, representing a leap forward in taxpayer interaction and convenience. The incorporation of voice bot technology into this widely used tool exemplifies the IRS’s commitment to leveraging modern solutions to improve taxpayer experiences.

The enhanced “Where’s My Refund?” is designed to provide clearer and more detailed information, making it easier for taxpayers to get the answers they need without direct contact with the IRS. This feature aims to streamline the information-gathering process, reducing the need for taxpayers to rely on traditional, often time-consuming, methods of communication with the IRS for basic inquiries.

This step towards technological integration in tax administration is part of a larger trend within the IRS towards digital transformation. By adopting technologies like voice bots, the IRS is not only modernizing its approach but also making tax-related processes more efficient and user-friendly. These technological initiatives are crucial in adapting to the evolving expectations of taxpayers in a digital age, ensuring that the IRS stays at the forefront of customer service and operational efficiency.

A New Era In the 2024 tax season, the IRS is clearly focused on meeting the evolving needs of taxpayers and professionals. Key strategies include implementing advanced technologies, enhancing customer service, and preparing for legislative updates. These efforts are central to effectively managing the tax season. Both tax professionals and taxpayers benefit from staying informed and adaptable, ensuring a smoother and less stressful tax experience.

Income-related documents: W-2s, 1099s, K-1s, and investment statements

Income-related documents: W-2s, 1099s, K-1s, and investment statements Expense records: Mortgage interest (Form 1098), business expense receipts, and medical bills

Expense records: Mortgage interest (Form 1098), business expense receipts, and medical bills Tax compliance forms: Prior-year tax returns, state-specific tax documents, and IRS correspondence

Tax compliance forms: Prior-year tax returns, state-specific tax documents, and IRS correspondence Reducing paper clutter and improving accessibility

Reducing paper clutter and improving accessibility Enhancing data security with encrypted storage

Enhancing data security with encrypted storage Facilitating quick retrieval of client records

Facilitating quick retrieval of client records

Choosing the right tax software is crucial for accuracy and efficiency. Best tax preparation software for 2025 should offer:

Choosing the right tax software is crucial for accuracy and efficiency. Best tax preparation software for 2025 should offer: Automated tax calculations for reduced errors

Automated tax calculations for reduced errors Seamless e-filing for federal and state tax returns

Seamless e-filing for federal and state tax returns Client portals for secure document exchange

Client portals for secure document exchange Automated data entry – Reduces manual errors

Automated data entry – Reduces manual errors AI-powered tax review – Identifies compliance issues

AI-powered tax review – Identifies compliance issues Automated client reminders – Keeps clients on track Facilitating quick retrieval of client records

Automated client reminders – Keeps clients on track Facilitating quick retrieval of client records

Sending tax reminders via email or text

Sending tax reminders via email or text Hosting webinars on tax law changes

Hosting webinars on tax law changes Providing FAQs to address common tax concerns

Providing FAQs to address common tax concerns Downloadable tax preparation checklists

Downloadable tax preparation checklists Informative tax planning newsletters

Informative tax planning newsletters One-on-one tax season consultations

One-on-one tax season consultations

Prioritize high-value tasks and batch similar work

Prioritize high-value tasks and batch similar work Set realistic client expectations

Set realistic client expectations Take breaks to maintain focus

Take breaks to maintain focus Outsourcing tax preparation to reliable third-party providers

Outsourcing tax preparation to reliable third-party providers Hiring seasonal staff for administrative work

Hiring seasonal staff for administrative work Using virtual assistants for appointment scheduling

Using virtual assistants for appointment scheduling Reduces workload during peak season

Reduces workload during peak season

Improves turnaround time for clients

Improves turnaround time for clients

Allow firms to focus on high-level advisory services

Allow firms to focus on high-level advisory services

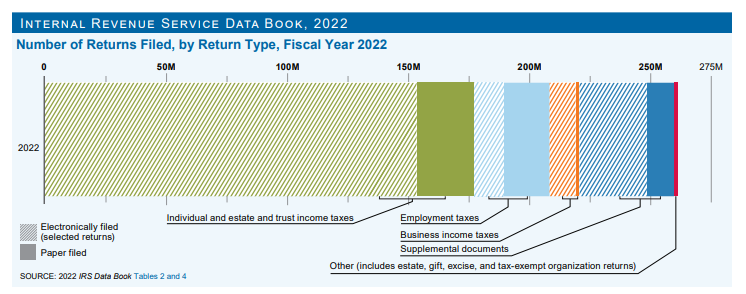

[SOURCE: IRS Data Book

[SOURCE: IRS Data Book