Unlock Innovation and Maximize Your Savings with

Unison Direct’s R&D Tax Credit Services

Our Promise: Fast, Efficient, and Reliable R&D Tax Credit Services

We know how valuable your time and resources are, which is why Unison Direct offers fast and efficient offshore R&D tax credit solutions without compromising quality. As a trusted R&D tax credit service provider, we are committed to transparency, ensuring you fully understand every step of the process.

Why Choose Unison Direct for Your R&D Tax Credit Needs?

- Accurate Opportunity Evaluation: Pinpointing all eligible R&D activities.

- Eligibility Confirmation: Ensuring your projects meet the IRS’s 4-part test.

- In-Depth Analysis: Identifying which components of your research are eligible for the credit.

- Form Preparation & Filing: Expert assistance with preparing and filing Form 6765, Form 8974, and all supporting documentation.

- Audit Support: Providing comprehensive support in the event of an IRS audit.

- Accurate Opportunity Evaluation: Pinpointing all eligible R&D activities.

- Eligibility Confirmation: Ensuring your projects meet the IRS’s 4-part test.

- In-Depth Analysis: Identifying which components of your research are eligible for the credit.

- Form Preparation & Filing: Expert assistance with preparing and filing Form 6765, Form 8974, and all supporting documentation.

- Audit Support: Providing comprehensive support in the event of an IRS audit.

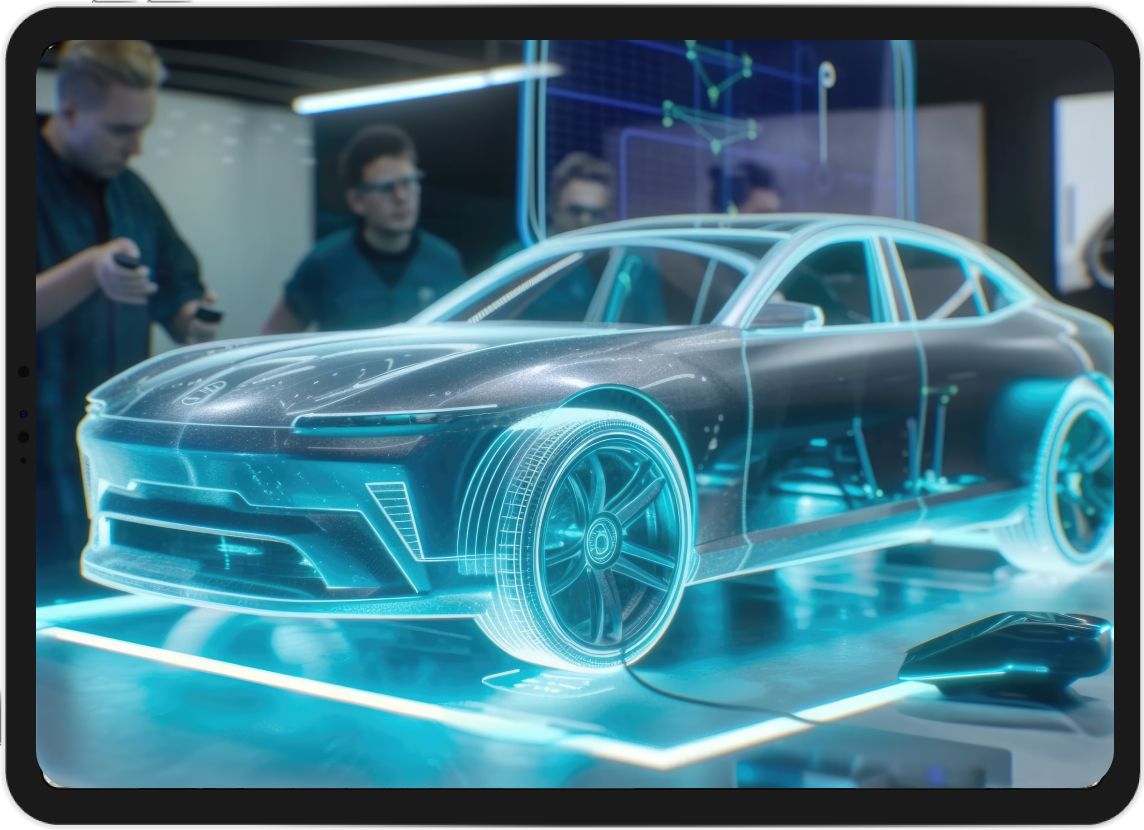

Industries We Serve with R&D Tax Credit Services

-

Tech Startups:

We specialize in R&D tax credit for tech companies and software development R&D tax credits. -

Biotech & Pharmaceuticals:

Leverage our R&D Tax Credit for pharmaceutical R&D and medical device tax credits. -

Manufacturing & Engineering:

Get expert support for R&D tax credits for manufacturers and engineering R&D tax incentives. -

Renewable Energy & Aerospace:

Explore our specialized R&D tax credit for renewable energy and aerospace R&D services.

FAQs

Reach out to us to discuss how we can enhance your research initiatives. Our team is ready

to guide you through the R&D tax credit landscape, ensuring a seamless and beneficial

experience.

Start maximizing your business R&D tax credit potential with the trusted experts at Unison Direct. Our R&D tax credit outsourcing solutions ensure that you receive every dollar you’re entitled to while reducing your tax burdens.

Contact us now to schedule a consultation and discover how we can help your business achieve greater financial efficiency with R&D tax credits.